iTrustCapital Login: Pros and Cons

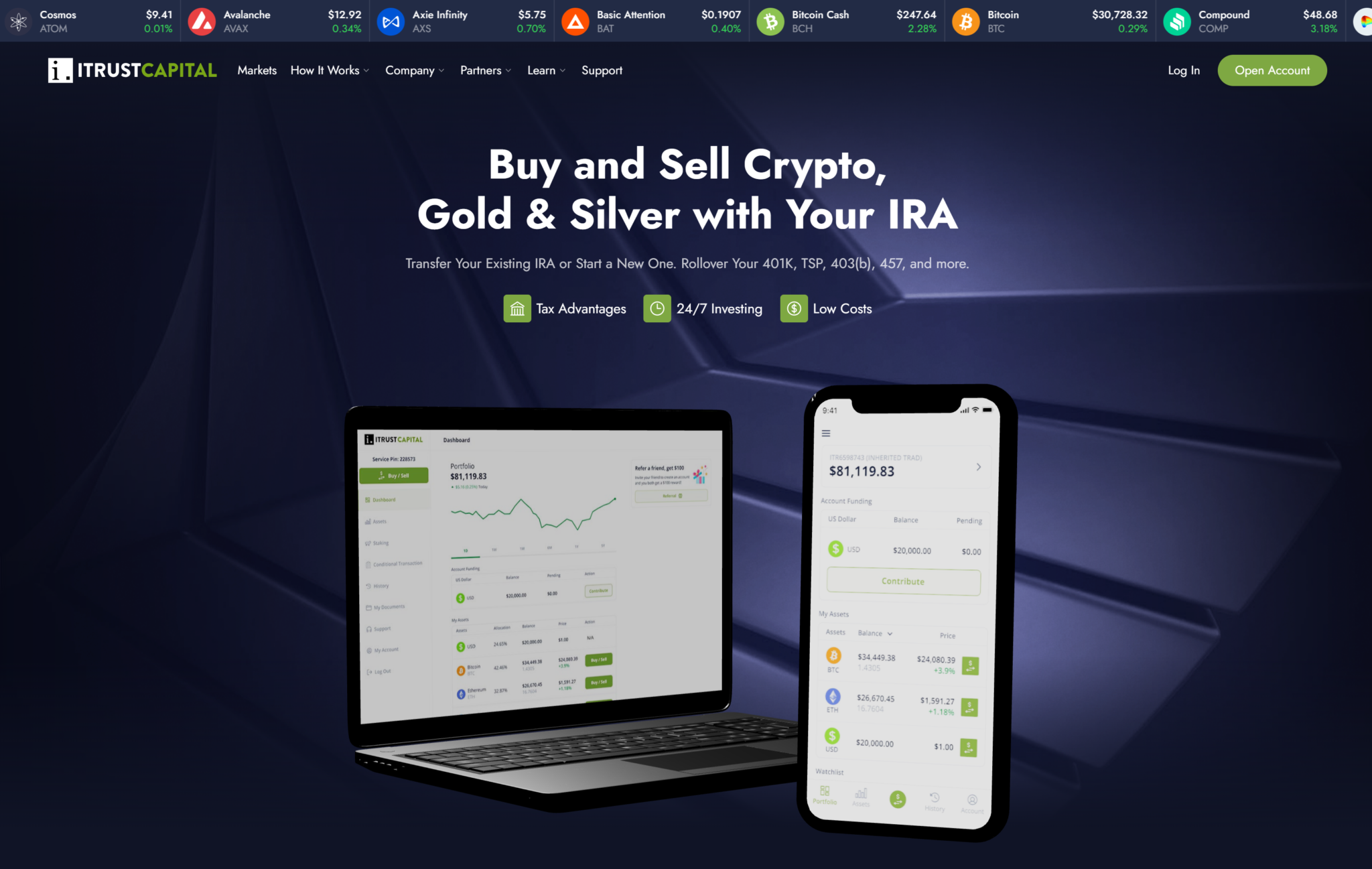

In the ever-evolving landscape of financial technology, iTrustCapital stands as a prominent platform offering individuals the opportunity to invest in cryptocurrencies and precious metals within tax-advantaged retirement accounts. With its user-friendly interface and promise of diversification, iTrustCapital has garnered attention from investors seeking alternative assets. However, like any financial platform, it comes with its own set of pros and cons that potential users should consider before diving in.

Pros:

- Tax Advantages: One of the primary draws of iTrustCapital is its provision of tax-advantaged retirement accounts. By allowing users to invest in cryptocurrencies and precious metals within IRAs and 401(k)s, iTrustCapital enables investors to potentially grow their wealth without immediate tax implications.

- Diversification: iTrustCapital facilitates diversification by offering a range of investment options beyond traditional stocks and bonds. Investors can allocate funds into cryptocurrencies like Bitcoin and Ethereum, as well as precious metals such as gold and silver, thereby spreading risk across different asset classes.

- User-Friendly Interface: The platform boasts a sleek and intuitive interface, making it accessible even to those with limited experience in cryptocurrency or precious metal investing. Users can easily navigate through the platform, execute trades, and monitor their portfolios with ease.

- Security Measures: iTrustCapital prioritizes the security of its users’ assets. The platform employs robust security measures, including encryption protocols and multi-factor authentication, to safeguard against unauthorized access and potential cyber threats.

- 24/7 Trading: Unlike traditional financial markets that operate within specific hours, iTrustCapital allows for 24/7 trading of cryptocurrencies and precious metals. This provides investors with greater flexibility and the ability to capitalize on market opportunities at any time.

Cons:

- Limited Asset Selection: While iTrustCapital offers a diverse range of investment options compared to traditional retirement accounts, its selection is still relatively limited. Users may find themselves restricted to a handful of cryptocurrencies and precious metals, potentially missing out on other emerging assets.

- High Fees: iTrustCapital charges fees for its services, including account maintenance fees and transaction fees. While these fees are comparable to those of other investment platforms, they can eat into investors’ returns over time, particularly for those with smaller portfolios.

- Market Volatility: Cryptocurrency and precious metal markets are notorious for their volatility. While this volatility presents opportunities for significant gains, it also exposes investors to substantial risks. Novice investors may find it challenging to navigate these fluctuations effectively.

- Regulatory Uncertainty: The regulatory landscape surrounding cryptocurrencies and precious metals is still evolving. Changes in regulations could impact the legality and taxation of investments held through iTrustCapital, potentially affecting investors’ portfolios and tax liabilities.

- Customer Support: Some users have reported issues with iTrustCapital’s customer support, citing delays in response times and difficulty in resolving issues. Improved customer service could enhance the overall user experience and provide peace of mind to investors.